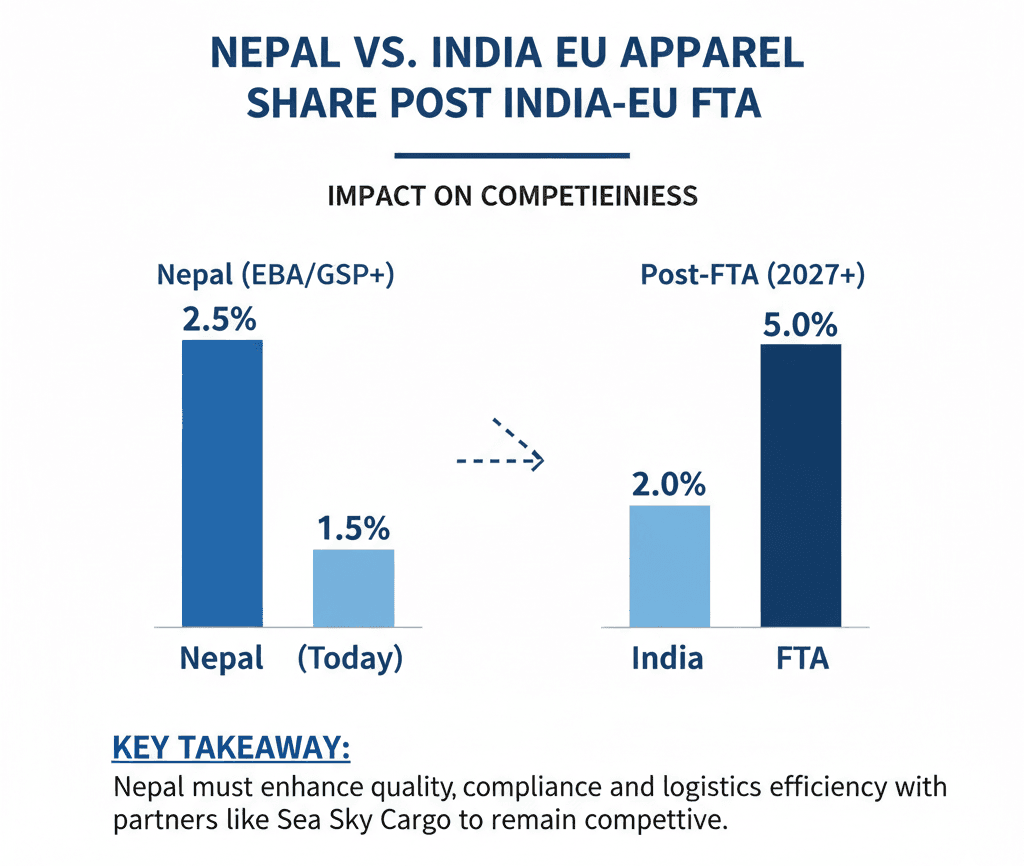

Customs Duties & Tariffs on Nepal Apparel to EU After EBA in 2026

Nepal Apparel's EU Lifeline: What Happens After EBA in 2026?

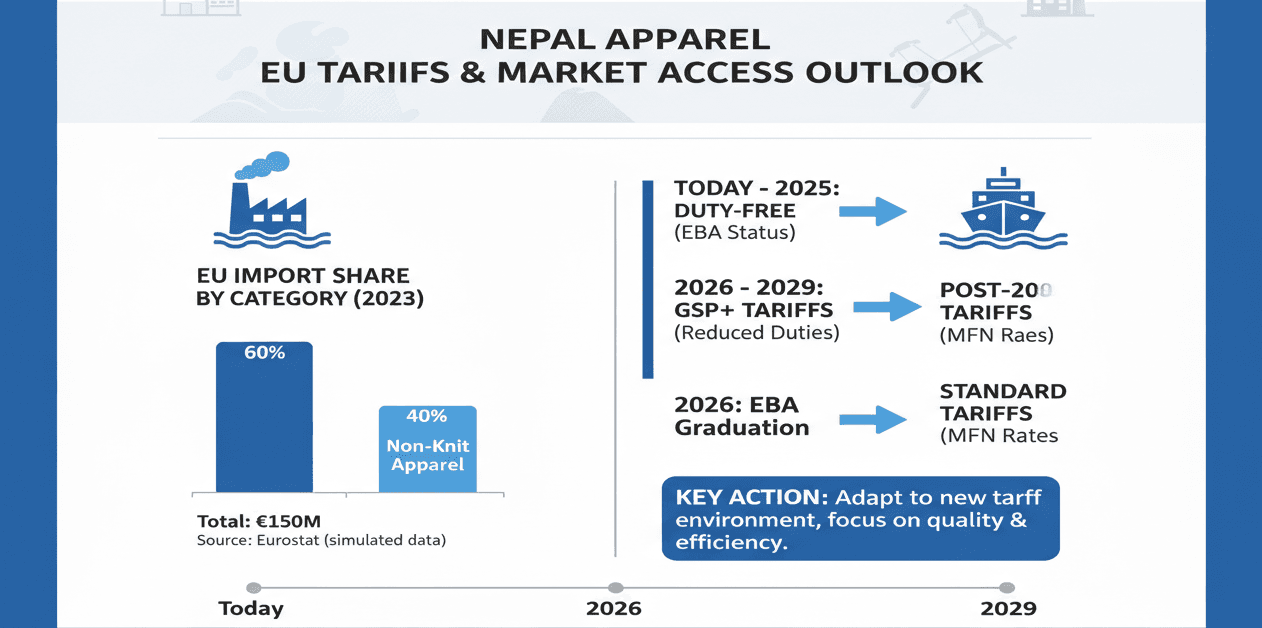

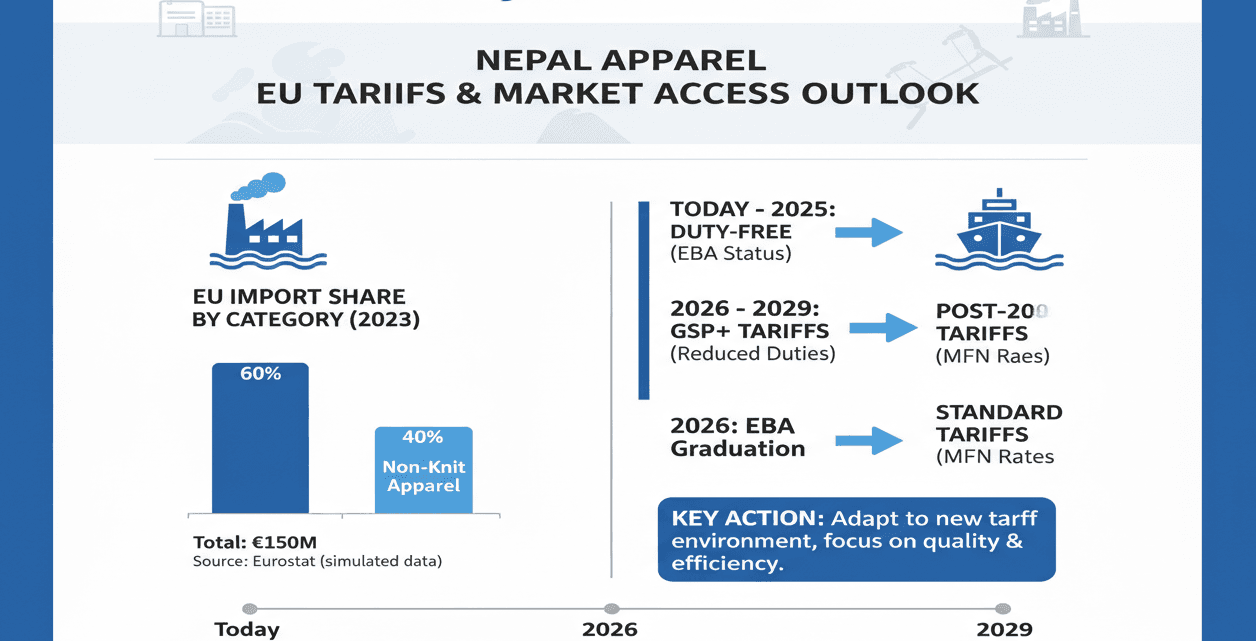

Nepal's apparel sector knit (22.5%) and non-knit (20.8%) making 43% of €98M+ EU exports thrives on duty-free access. But with LDC graduation November 2026, Everything But Arms (EBA) ends... or does it? Good news: EU grants a 3-year transition to 2029, keeping zero tariffs intact.

Post-2029? Shift to GSP or GSP+ (0-12% duties vs. MFN 12%). This guide breaks duties, compliance, and strategies amid India-EU FTA competition.

Current EBA Status: Zero Duties Until When?

Under EBA (LDC perk), Nepal apparel enters 27 EU states duty-free/quota-free (except arms). 2024-25: €42M+ garments alone.

2026 Impact: LDC graduation triggers 3-year EBA extension (to Nov 2029) zero duties continue. Verbal EU assurances for garments waiver during transition.

No immediate hike: Exporters cash in till 2029 while chasing GSP+.

Post-2029 Tariffs: GSP vs. MFN for Apparel

After transition:

Standard GSP: Duties on Apparel 0-4.5% (knits), Coverage Most textiles, Requirements Basic rules of origin.

- GSP+: Duties on Apparel 0% (if ratified), Coverage 66% tariff lines, Requirements 27 conventions (labor/human rights).

- MFN: Duties on Apparel 12% avg, Coverage Full, Requirements WTO standard no prefs.

GSP+ target: Ratify ILO/environment pacts; EU monitoring. Utilization: 85-90% now.

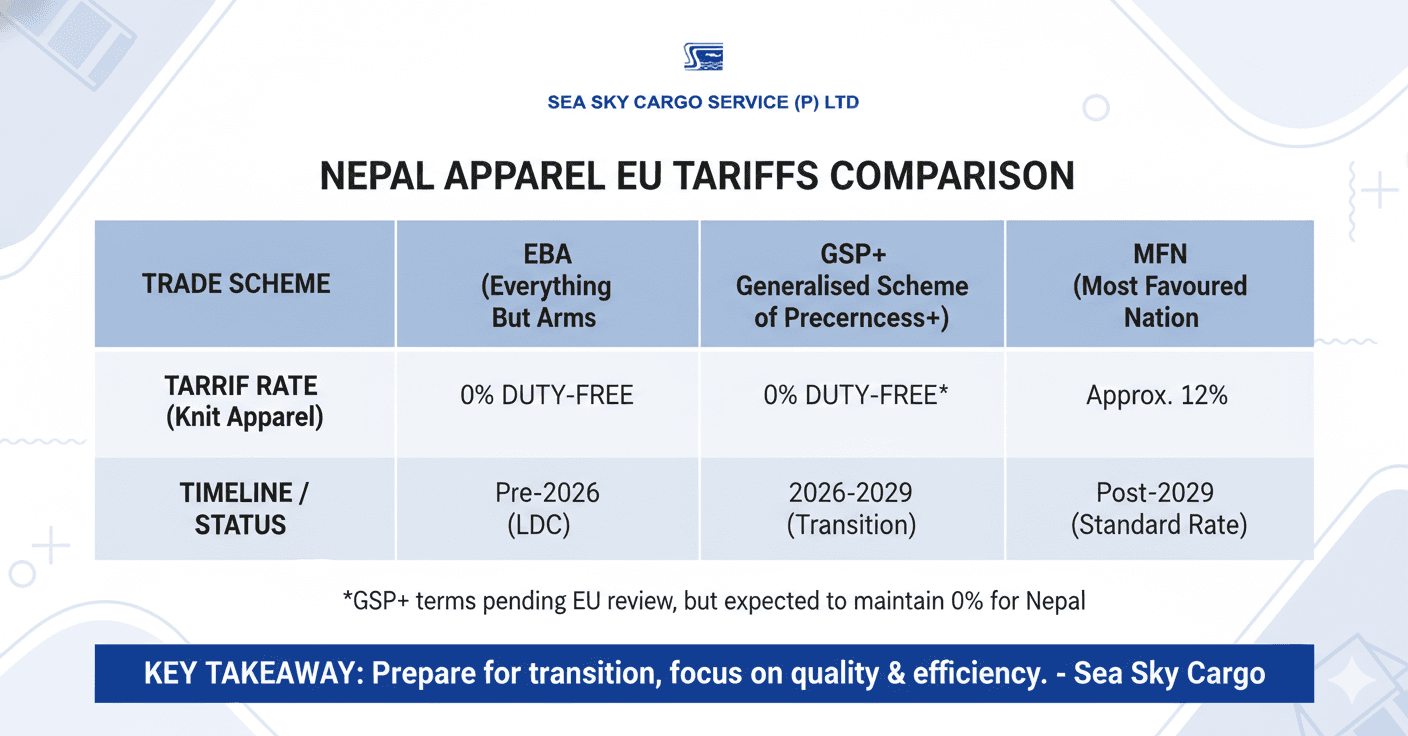

India-EU FTA (96% duty-free) ramps competition—Nepal duties could add 4.3% export drop without GSP+.

Compliance Essentials for Zero/Low Duties

Secure prefs:

- Rules of Origin: 50-60% Nepali value; Form A cert via TEPC.

- REACH/GOTS: Chemical/dye labels for textiles.

- Docs: Invoice, packing list, fumigation (wood packs).

- Transition Certs: EU verbal waiver apps for garments

Sea Sky Cargo handles: Pre-clearance, labeling, EU broker links.

Risks & Strategies Amid India-EU FTA

India's FTA phases 96% exports duty-free (textiles immediate)—Nepal loses edge post-2029. Strategies:

- Maximize EBA to 2029 (Rs 12B+ EU exports FY25).

- Push GSP+ ratification (garment waiver).

- Diversify: US/UK markets, value-add (organic knits).

- Logistics edge: Air TIA for speed vs. India's scale.

Forecast: 4-6% export dip without action; GSP+ caps at 1-2%.

Conclusion: Secure Your EU Edge Now

EBA's 2026 "end" is a myth zero duties hold till 2029 via EU transition. Gear up for GSP+: Certs, compliance, advocacy. Apparel exporters, maximize while it lasts partner logistics pros like Sea Sky for seamless docs/routes.

Don't let graduation derail: Act 2026 for duty-free futures.