Shipment Customs Clearance in 2025: How to Keep Your Cargo Moving

Why Shipment Customs Clearance Matters More Than Ever

Customs clearance is the gate every international shipment must pass through, and it is often where cargo either keeps flowing or comes to a standstill. Globally, studies show that clearance delays add days to transit times, increase inventory costs, and can cause complete write‑offs for sensitive goods like pharmaceuticals or perishables. For traders in emerging markets, the impact is even greater: in Nepal, for example, logistics costs are estimated at more than 25% of export value, with cumbersome customs procedures cited as a major driver.

Trade volumes are also growing, which puts more pressure on border systems. Nepal’s total trade reached around Rs 2.08 trillion in the fiscal year ending mid‑July 2025, with imports about Rs 1.80 trillion and exports Rs 277 billion. Each of those movements required customs processing, making efficient shipment customs clearance central to the country’s trade performance and to every exporter’s cash flow.

The State of Customs Clearance: Delays, Indices, and Performance

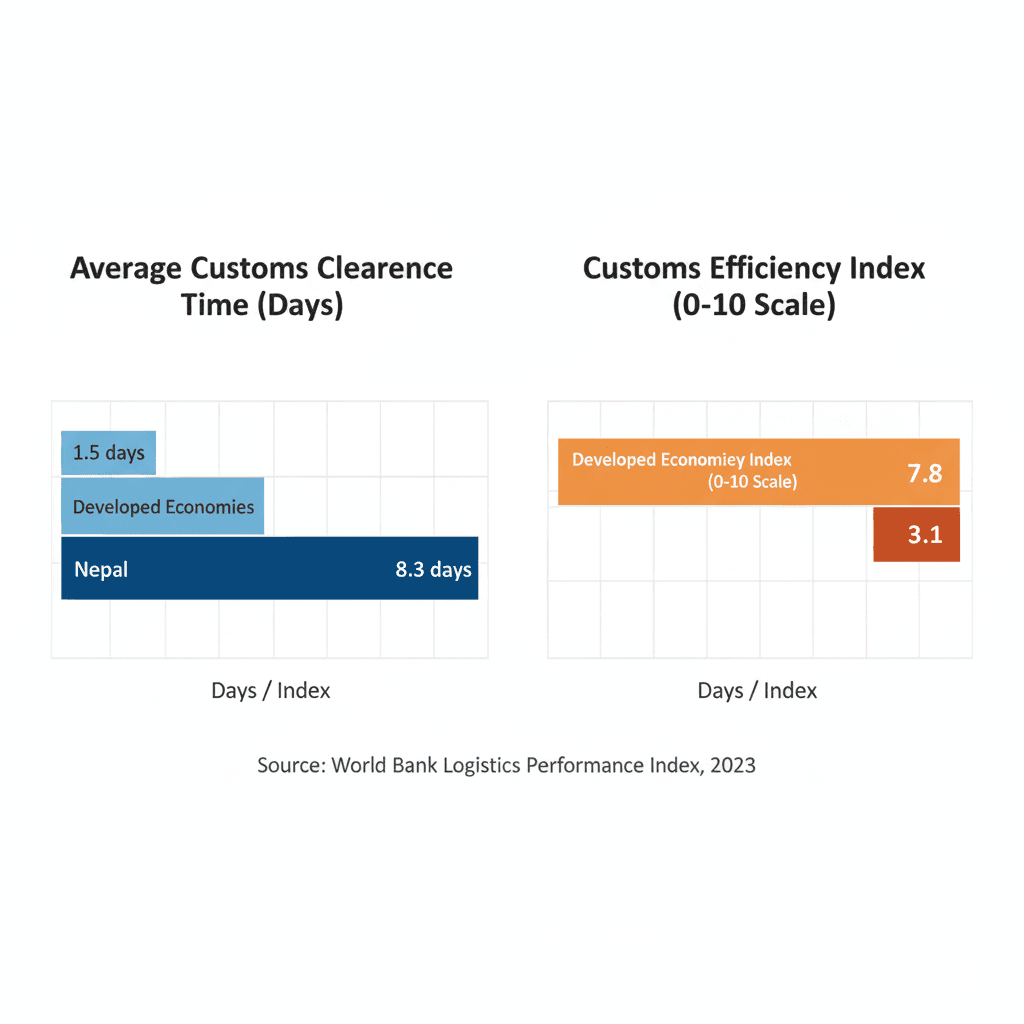

International data confirms that customs performance directly shapes trade competitiveness. In Europe, average clearance times of two to three days are common, and any delay beyond that increases warehousing, financing, and spoilage costs. For developing economies, World Bank indicators show even longer times; some exporters report dozens of hours spent on documentary compliance alone.

Nepal’s own logistics performance has historically struggled in this area. The World Bank’s Logistics Performance Index once gave the country a customs efficiency score below 2 on a scale of 1 to 5, reflecting slow, paper‑heavy, and inconsistently applied procedures. A related “Trading Across Borders” study found that exporters faced around 11 hours for border compliance and 43 hours for documentary compliance on average, with related costs above USD 200 per shipment. When multiplied across thousands of consignments, those hours translate into lost opportunities, higher prices, and reduced competitiveness.

Digital Transformation: Online Valuation and E‑Customs Systems

The good news is that shipment customs clearance is changing fast as governments embrace digital tools. Nepal, for instance, has begun piloting an online valuation database and expanding the use of its ASYCUDA‑based e‑customs platform. The new database records transaction values of previously imported items, helping customs officers verify declared values and reducing disputes over under‑ or over‑valuation.

These reforms aim to:

- Speed up clearance and cut border wait times.

- Reduce arbitrary “reference pricing” and increase transparency for traders.

- Simplify documentation through electronic submissions, e‑payments, and single‑window concepts.

Nepal’s total trade currently accounts for about 30.6% of its GDP, which makes even modest efficiency gains in customs clearance highly valuable for the national economy. Trade experts note that digital valuation databases, if paired with honest declarations and consistent enforcement, can significantly reduce misunderstandings, curb fraud, and lower transaction costs.

Why Shipments Get Stuck: Common Causes of Customs Delays

Even with new technology, the biggest sources of shipment customs clearance delays remain human and procedural. Global customs and logistics analyses list several recurring culprits:

- Incomplete or inaccurate documentation – Missing invoice details, wrong values, or inconsistent packing lists.

- Incorrect HS (harmonized) codes – Misclassification triggers extra review and sometimes penalties.

- Non‑compliance with regulations – From product standards to license requirements, omission can stop cargo at the border.

- Poor coordination between freight forwarders and customs brokers Miscommunication means key information or documents don’t arrive in time.

- Random inspections and risk profiling – Some holds are unavoidable, but good compliance reduces how often they occur.

Research indicates that strong compliance and modern customs management practices can reduce clearance‑related delays by up to 40%, directly benefiting exporters and importers through faster turnaround and lower costs

Nepal’s Customs Network: Scale, Trade, and Pressure Points

To understand why efficient shipment customs clearance matters so much, it helps to look at the scale. Nepal operates around 28 customs offices nationwide, handling imports valued at roughly Rs 1,804 billion and exports worth Rs 277 billion in the 2081/82 fiscal year. Major gateways such as Birgunj, Bhairahawa, Kakarbhitta, and Mechi process a large share of this traffic and regularly report sharp swings in import volumes and export revenues.

These border points face a combination of infrastructure constraints limited warehousing, cold storage shortages, and congested access roads and administrative challenges such as overlapping paperwork and manual verification steps. Studies highlight that total logistics costs for exporters can exceed 25% of the product cost once delays, extra storage, and informal payments are included. As a result, companies that master customs clearance gain a real competitive edge, while those that treat it as an afterthought pay in both time and money.

Best Practices for Faster, Safer Shipment Customs Clearance

Given the stakes, businesses are increasingly professionalising their approach to shipment customs clearance. Industry guidance and case studies point to several high‑impact practices:

- Invest in documentation quality: Ensure invoices, packing lists, certificates of origin, and transport documents are complete, consistent, and error‑free.

- Use accurate HS codes: Proper classification reduces the chances of audits and re‑assessment, and it protects you from unexpected duty disputes.

- Align Incoterms and responsibilities: Clear agreement on who handles customs (exporter or importer) avoids gaps in paperwork and payments.

- Work with experienced customs brokers and forwarders: Professionals who know local rules and digital systems can pre‑clear shipments, flag risks, and resolve queries before they become blocks.i

- Leverage digital tools: E‑payment of duties, online declarations, and electronic document storage all cut processing time and make audits easier to handle.

At a strategic level, large multinationals are now treating customs management as a core part of supply‑chain design, not a back‑office function. Analysts argue that well‑managed customs processes can unlock hidden value by reducing dwell time, inventory buffers, and write‑offs in global trade networks

The Future: Smarter, More Transparent Customs Clearance

Looking ahead, shipment customs clearance is on track to become more digital, more data‑driven, and if reforms stay on course more predictable. Programs like Nepal’s customs reform and modernisation plan, backed by development partners such as the Asian Development Bank, aim to extend electronic documentation, standardise valuation practices, and expand risk‑based targeting across border points.

Internationally, similar initiatives are underway: the EU is rolling out unified digital customs portals, and many regions are experimenting with AI‑assisted risk analysis and blockchain‑based documentation to fight fraud and speed up processing times. For traders, this means that mastering shipment customs clearance will increasingly involve integrating digital systems,