Shipping to Canada from Nepal in 2026: What You Really Need to Know

Canada Is Far, But Shipping There Doesn’t Have to Be Hard

Maybe you’re sending a few cartons of pashmina to Toronto, a sample shipment of carpets to Vancouver, or simply gifts to family in Calgary. Canada sounds distant and bureaucratic but if you understand the basics, shipping from Nepal can be smooth, predictable, and surprisingly affordable.

This guide walks you through methods, documents, customs, taxes, and a few insider tricks for 2026.

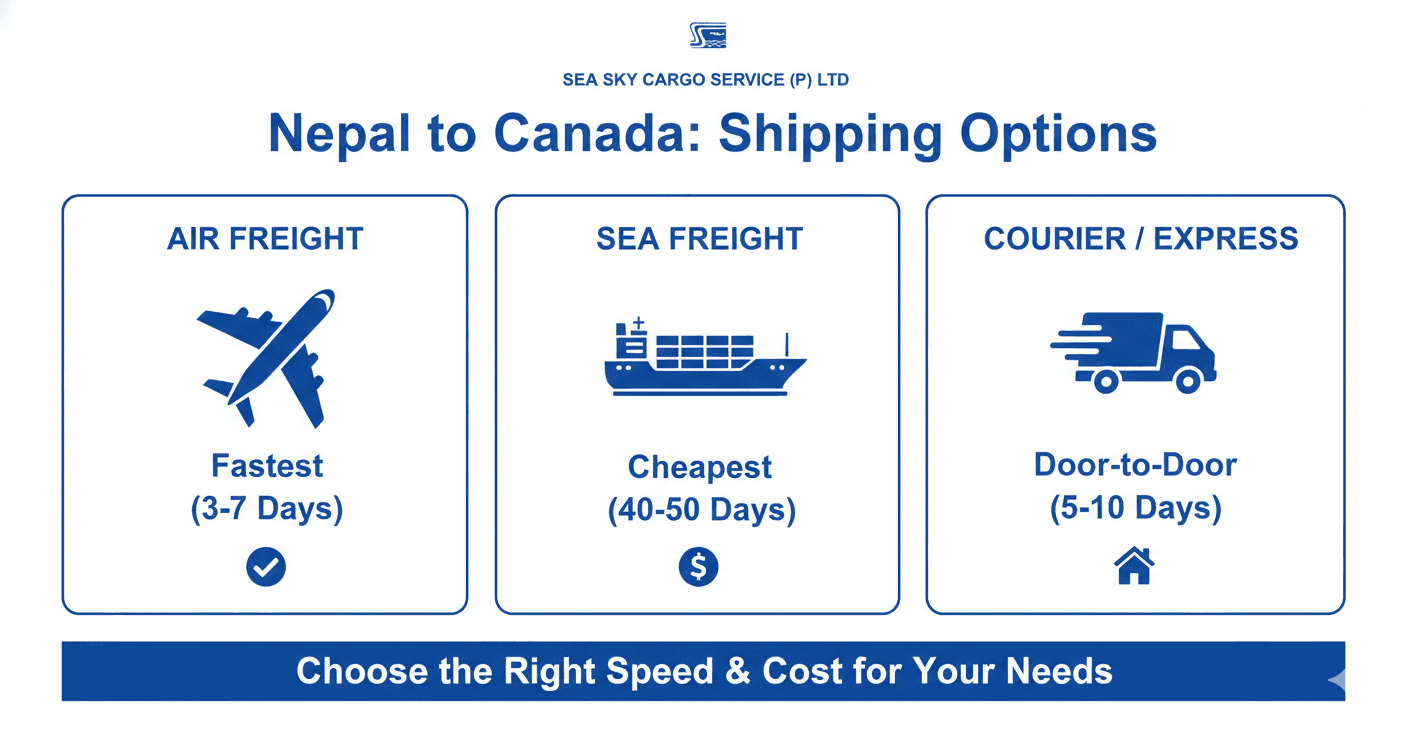

Choose Your Shipping Method: Air, Sea, or Courier

Your first big decision is how to ship. Each option trades time for money.

- Air freight (airport-to-airport or door-to-door)

- Transit: Usually 5–10 business days from Kathmandu to major Canadian airports like Toronto (YYZ) or Vancouver (YVR), plus customs time

- Best for: Commercial shipments, apparel, carpets, electronics, urgent or high-value goods.

- Pros: Fast, reliable schedules, better control.

- Cons: More expensive per kilo than sea.

- Sea freight (via India)

- Route: Truck/rail from Nepal to Kolkata or other Indian ports, then ocean freight to Vancouver, Montreal, or Halifax

- Transit: Around 25–45 days, sometimes longer depending on routing and port congestion.

- Best for: Heavy, bulky, or wholesale shipments where speed isn’t critical.

- Pros: Much cheaper per kilo, good for large pallets or containers.

- Cons: Slower and more paperwork, especially through India.

- Courier / Express services

- Transit: 24–72 hours for small parcels with premium express, but allow extra for customs.

- Best for: Documents, samples, online orders, gifts usually under 30–40 kg.

- Pros: Door‑to‑door, tracking, simpler for individuals.

- Cons: Highest cost per kilo; customs and tax still apply over very low thresholds.

Understand Shipping Costs: What Really Drives the Price

Shipping to Canada isn’t just “distance = cost.” Several factors stack up:

- Weight & volume:

- Couriers charge on chargeable weight (the higher of actual vs. volumetric).

- Air freight also uses volumetric weight for large but light cartons.

- Service type:

- Express 2–3 day deliveries cost more than economy or consolidated options.

- Destination in Canada:

- Major cities (Toronto, Vancouver, Montreal) are cheaper than remote locations that involve extra “beyond” charges.

- Customs duties, GST/HST:

- The buyer or receiver in Canada usually pays import charges at arrival—this can be a big part of the total cost.

- Insurance:

- Optional but smart for valuable shipments; cost is usually a small percentage of the declared value.

A good forwarder will give you a landed cost estimate including freight, estimated duties, and taxes so there are no surprises at delivery.

Pack and Label Like a Pro

Canada Post and private couriers see thousands of international parcels every day. Poor packing is one of the main reasons for damage or delays.

Key packing tips:

- Use strong, double‑walled cartons for heavier items like carpets or brassware.

- Wrap individual items with bubble wrap or foam to prevent movement.

- Seal with heavy‑duty tape on all seams, not just the top flap.

- Add internal cushioning to absorb impacts.

Labelling essentials:

- Receiver’s full name, street address, postal code, phone number, and email.

- Your return address in Nepal.

- Any “Fragile”, “This Side Up”, or “Heavy” labels as needed.

For commercial cargo, the label should match the commercial invoice and packing list.

Documentation: What Canada Customs Wants to See

Canada Border Services Agency (CBSA) is strict but predictable if your paperwork is in order.

For commercial shipments, you’ll typically need:

- Commercial Invoice – item description, HS code (if known), quantity, unit price, total value, currency, Incoterms.

- Packing List – weight and dimensions of each carton.

- Waybill / Bill of Lading – provided by your carrier or forwarder.

- Certificates or permits if applicable:

- Textile/apparel labels and possible permits (Tariff Preference Level programs).

- CITES or wildlife permits for items using certain animal products (e.g., some furs, exotic skins).

For personal shipments or gifts by courier:

- A detailed contents declaration and true value is still required. Under‑declaring value to “save tax” is risky and can lead to fines or seizure.

Duties, Taxes, and Canada’s De Minimis Rules

Canada charges two main kinds of import costs: duties and sales tax (GST/HST).

- Duties

- Rate depends on the HS code, the value, and the origin of your goods.

- Textiles and apparel, for example, can face duties around 17–18% if they don’t qualify for special tariff programs.

- GST/HST

- Canada applies 5% GST, plus provincial HST in some provinces, on the customs value plus duty.

De minimis for courier shipments (small parcels):

- From countries other than the US or Mexico (which includes Nepal):

- If the parcel value is CAD 20 or less, duties and taxes are generally not collected.

- Above CAD 20, duties and taxes can apply on courier imports.

Remember: these thresholds mainly help with small consumer parcels shipped by courier. Commercial freight is almost always fully assessed.

Special Rules for Textiles, Apparel, and Handicrafts

If you’re exporting clothing, fabrics, or certain handicrafts, there are a few extra things to know:

- Mandatory labelling – fibre content, country of origin, and care instructions in English and/or French must be durable and accurate.

- Tariff Preference Levels (TPL) – Some trade agreements allow reduced duty on a limited volume of textiles under special permits.

- Cultural or wildlife materials – Items using animal skins, feathers, or rare woods may need CITES documentation or can be restricted.

A Canadian customs broker or an experienced forwarder can check whether your products qualify for any reduced‑duty programs or need permits.

Conclusion: Ship to Canada with Sea Sky Cargo – Nepal's Trusted Partner

Shipping to Canada from Nepal is no longer a shot in the dark. When you choose the right mode (air, sea, or courier), pack smart, complete clean paperwork, and respect Canada’s customs rules, your cargo can move reliably whether it’s one gift box or a full pallet of export goods.

Partner with Sea Sky Cargo Service, 38 years mastering Nepal’s landlocked logistics since 1988. From TIA air to Kolkata sea gateways, they handle your Canada shipments door-to-door with expert docs, CBSA compliance, and real-time tracking.